ES and NQ Analysis

🟩 ES1! — S&P 500 E-mini Futures (Daily)

🧠 Context

• Price is consolidating just below a major supply zone marked by a fair value gap (FVG).

• Recent momentum has slowed, with price pausing near prior swing highs.

🔴 Resistance Behavior

• A large FVG sits just overhead, acting as potential distribution or rejection territory.

• Sellers may be defending this area, aiming to trap late buyers.

🟢 Demand Structure

• Multiple FVGs below show where institutions previously stepped in.

• The closest FVG could act as support on a minor pullback.

• Deeper FVGs offer high-reward zones if structure breaks lower.

🧭 Trade Scenarios

• Bullish case: Clean break above current resistance confirms continuation — watch for pullbacks into prior demand.

• Bearish case: Rejection from current zone could send price into lower FVGs, offering short setups or long reload zones.

🟦 NQ1! — NASDAQ 100 E-mini Futures (Daily)

🧠 Context

• Price is holding above a recent FVG and consolidating near highs.

• Momentum remains intact but daily ranges are tightening.

🔴 Resistance Behavior

• Sellers continue to defend the upper boundary of this range.

• Lack of expansion may indicate buyer exhaustion in the short term.

🟢 Demand Structure

• A stack of FVGs below signals prior institutional support.

• Structure remains bullish as long as these zones continue to hold.

• Breakdown through the base could shift control to sellers.

🧭 Trade Scenarios

• Bullish case: Expansion through current resistance confirms continuation — pullbacks into demand provide long opportunities.

• Bearish case: Breakdown and follow-through from current range opens room to explore lower demand levels for either short setups or re-entries.

CURRENT LONGS (FROM YETSRDAY’S FL:

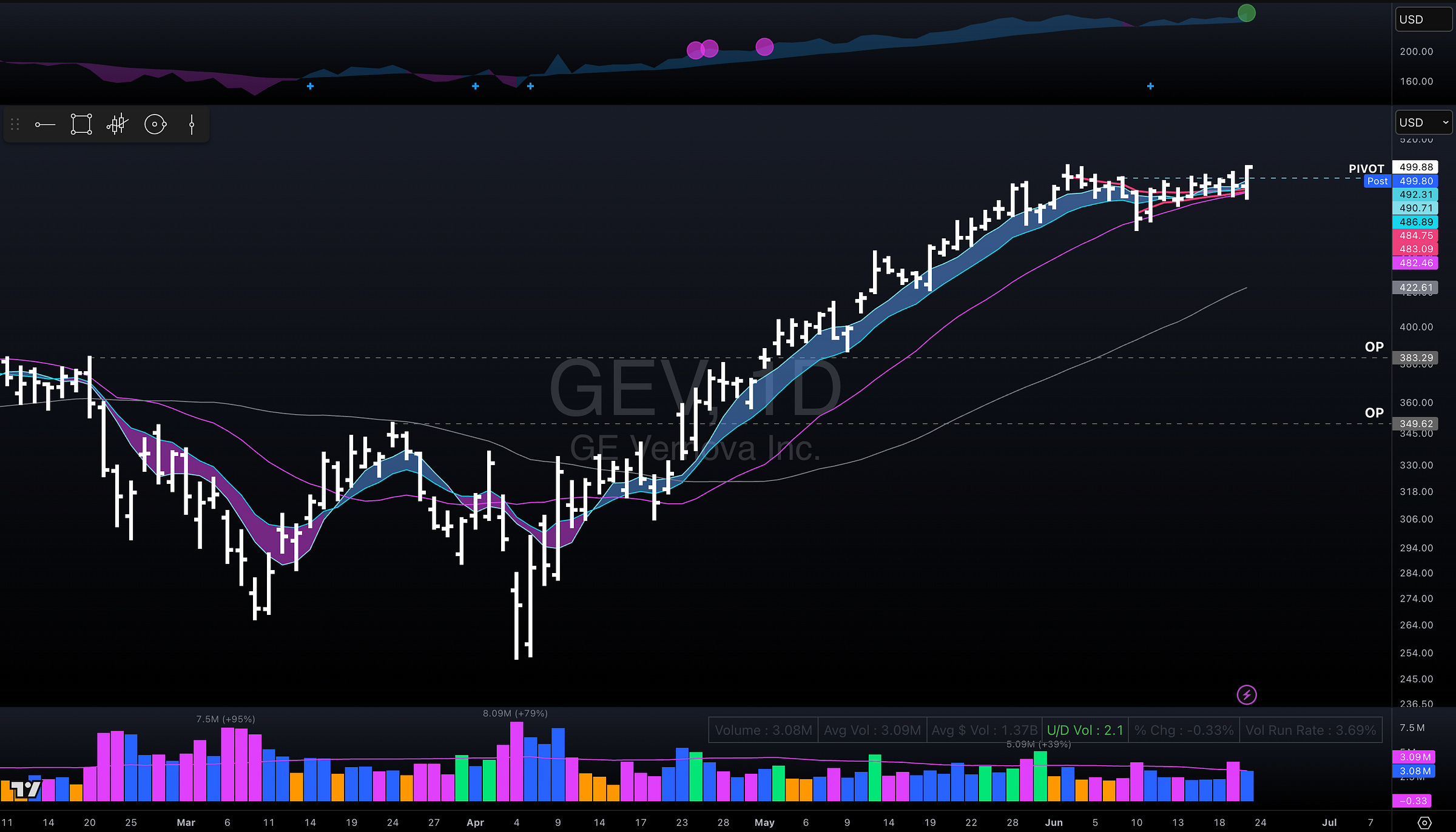

GEV (GE Vernova Inc.) – Took Entry Through Pivot After Coil Break

Entry Thesis

Initiated position as price broke cleanly through the pivot after forming a tight multi-session coil. Action showed clear accumulation, with anchored support rising and RS holding strong.

Execution Notes

Waited for the breakout through pivot after multiple inside bars. Entered on confirmation with expanding range and follow-through. Volume came in clean on the move, confirming commitment.

Management Plan

Now holding above the breakout level with price riding MA stack. Will continue to hold while structure remains intact. Watching for continuation through prior highs, and will consider trimming if price fails back into the coil.

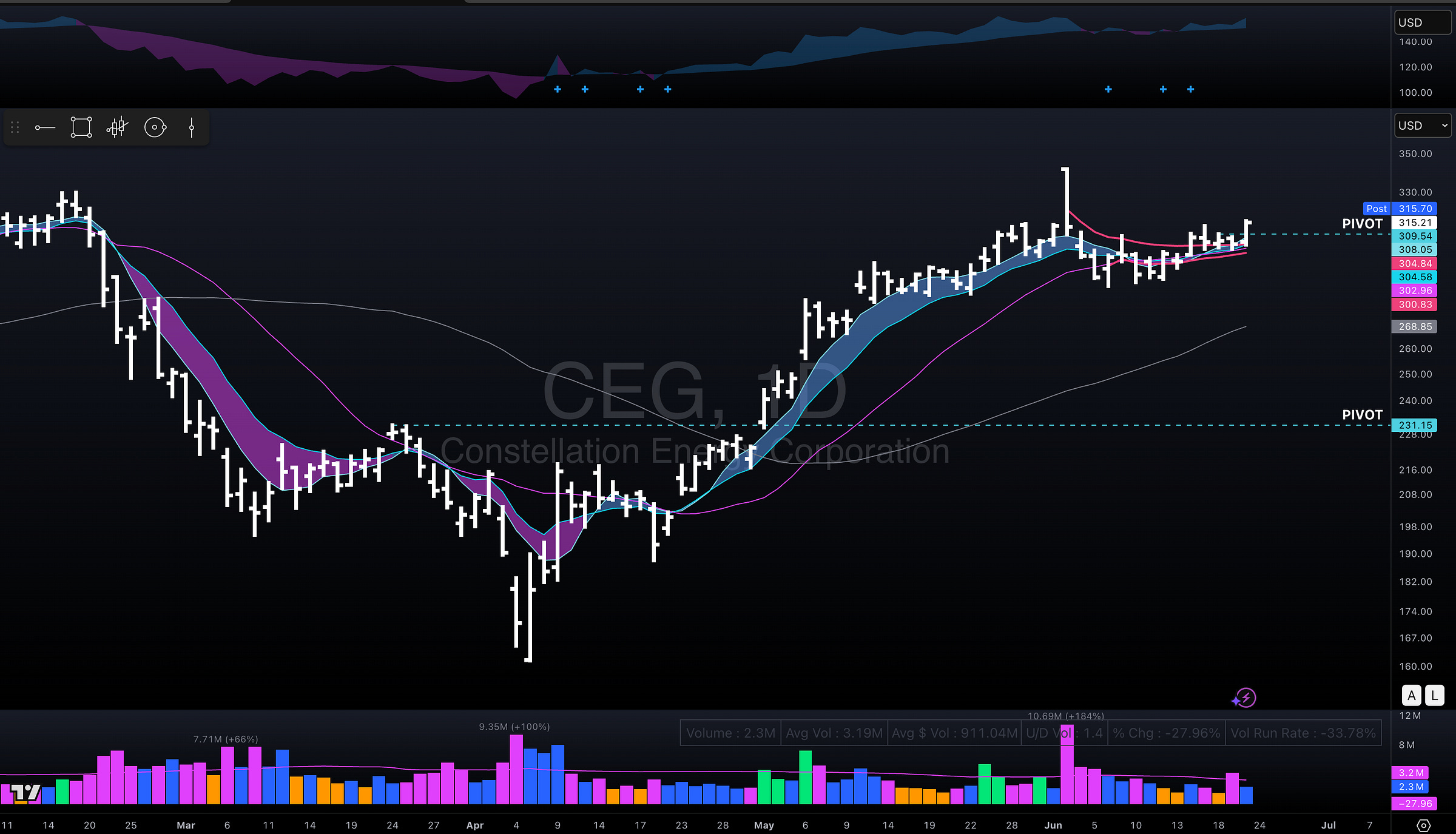

CEG (Constellation Energy Corp.) – Entered Through Pivot After Tight Flag Resolution

Entry Thesis

Took entry as CEG broke out of a tight flag just above the rising MA stack. The setup had been forming cleanly for over a week with clear compression and controlled pullbacks.

Execution Notes

Got long on the first close above the pivot zone after multiple inside days. Breakout was supported by a tightening range and rising RS, with price reclaiming leadership positioning.

Management Plan

Price is holding above the pivot and riding short-term MAs. Will stay long as long as structure stays clean and the flag doesn’t fail back into range. Watching for expanding volume to confirm continuation.

FOCUS LIST:

AVGO

NVDA

JBL

EAT

CDTX (HIGH RISK)

Keep reading with a 7-day free trial

Subscribe to The Trading Report BY SHRED to keep reading this post and get 7 days of free access to the full post archives.