The Trading Report 06/21/2025

I'm back with a new format. Next week's report will go paid. Enjoy!

ES and NQ Analysis

🟩 ES1! — S&P 500 E-mini Futures (Daily)

🧠 Context

• Price is consolidating just below a major supply zone marked by a fair value gap (FVG).

• Recent momentum has slowed, with price pausing near prior swing highs.

🔴 Resistance Behavior

• A large FVG sits just overhead, acting as potential distribution or rejection territory.

• Sellers may be defending this area, aiming to trap late buyers.

🟢 Demand Structure

• Multiple FVGs below show where institutions previously stepped in.

• The closest FVG could act as support on a minor pullback.

• Deeper FVGs offer high-reward zones if structure breaks lower.

🧭 Trade Scenarios

• Bullish case: Clean break above current resistance confirms continuation — watch for pullbacks into prior demand.

• Bearish case: Rejection from current zone could send price into lower FVGs, offering short setups or long reload zones.

🟦 NQ1! — Nasdaq 100 E-mini Futures (Daily)

🧠 Context

• Strong uptrend with a series of higher highs and higher lows.

• Current action is slowing, with price stalling just under recent highs.

🟢 Demand Zones

• Several FVGs beneath current price highlight layered institutional support.

• Most recent bullish impulses left clean FVGs, now acting as demand zones.

🟡 Structure Caution

• Although structure remains bullish, indecision near highs suggests possible short-term pullback.

• Lack of strong follow-through on recent highs may indicate liquidity grab or distribution.

🧭 Trade Scenarios

• Bullish case: A breakout and clean continuation higher confirms trend strength; demand zones below are valid for pullbacks.

• Bearish case: Breakdown from current consolidation could open the path to lower FVGs for support or short-term reversals.

CURRENT LONGS:

None at the moment. I’m coming back from a six month hiatus.

FOCUS LIST:

GEV

JBL

CEG

NVDA

EAT

GEV (GE Vernova Inc.) – Tight Coil Under Pivot with AVWAP Support

Trend

Strong, orderly uptrend—multiple legs higher with shallow, controlled pullbacks.

Price Structure

Currently consolidating just below pivot in a tight coil. Pullbacks have been minimal, with strong demand showing at each dip.

Pivot

$498.06 is the key level. Price is hovering just underneath, forming a base without breaking structure.

RS Read

RS line is rising and hitting new highs—GEV continues to outperform the market.

AVWAP Read

Price is sitting above a rising AVWAP from a prior swing low—suggesting buyers are in control and anchored participants are in profit. This level is acting as support, reinforcing the coil.

Conclusion

GEV is coiled under pivot, riding AVWAP support with strong RS—setup is constructive. A breakout through $498 with volume could trigger continuation.

JBL (Jabil Inc.) – HVC Setup

Trend

Powerful uptrend with a recent high-volume breakout and gap—clear momentum continuation.

Price Structure

Tight post-HVC flag just above $190.08. Price holding gains cleanly with controlled consolidation.

Pivot

Key resistance at $206.08. Price stalling just below—setup coiling for potential breakout or retest.

RS Read

RS line hitting highs but showing extension (blue dots). Momentum strong, but short-term pause likely.

Extension Risk / Retest Watch

Potential retest of HVC AVWAP (~$190–192)

Conclusion

Setup remains bullish, but extended—look for AVWAP or HVC reaction to enter on strength with better risk/reward.

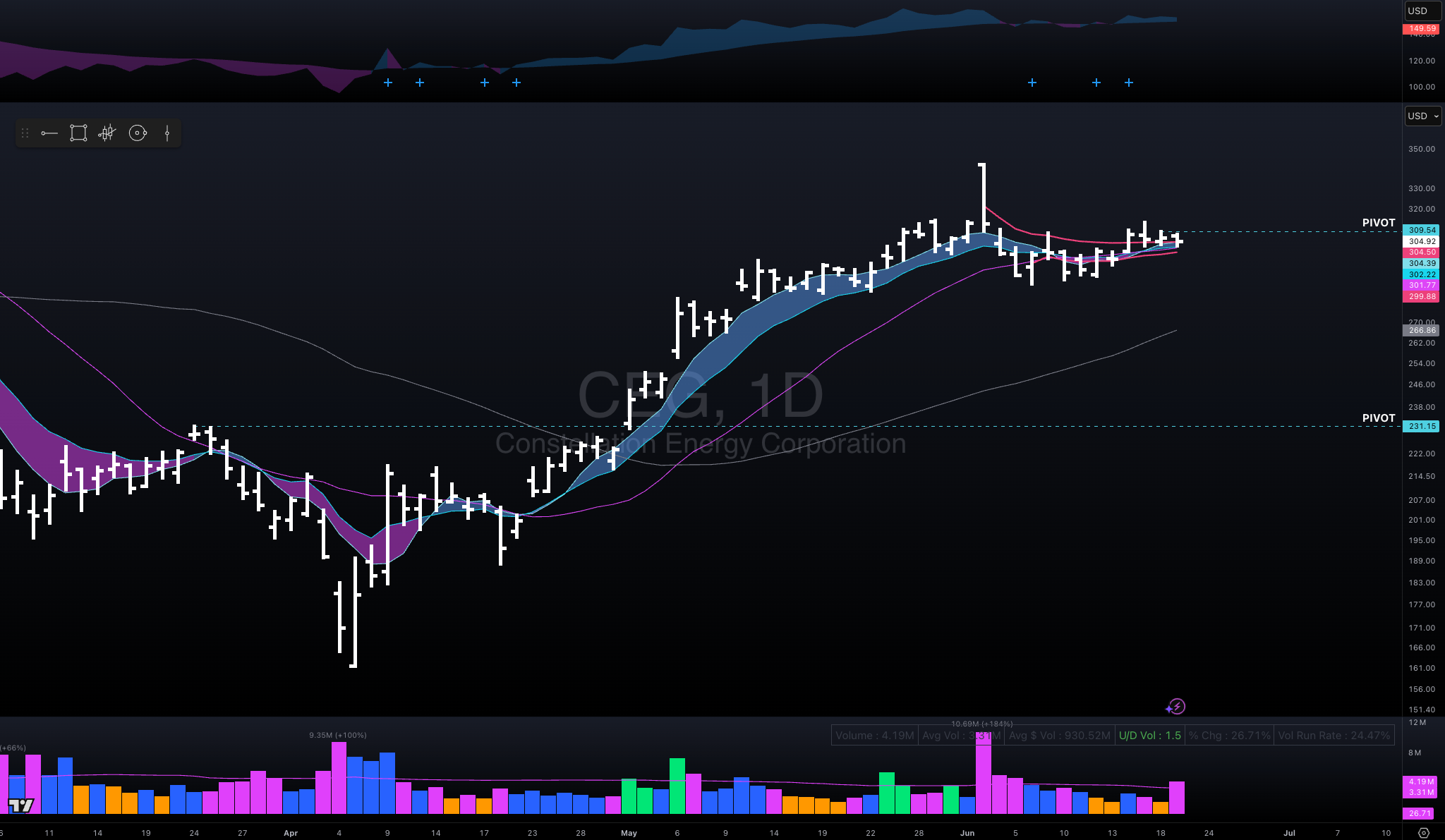

CEG (Constellation Energy Corp.) – Coil Under Pivot with AVWAP Overhang

Trend

Uptrend intact—recent action is consolidative after a strong April–May advance.

Price Structure

Price is coiling tightly just below pivot, compressing between short-term moving averages and anchored VWAPs from prior swing points.

Pivot

$309.94 remains key resistance—multiple failed attempts to clear and hold above.

RS Read

RS line has stalled—still elevated, but no recent highs. Stock is not currently leading.

AVWAP Read

Price is trapped beneath stacked AVWAPs, suggesting prior buyers are still underwater. These levels represent supply zones that must be absorbed before continuation.

Conclusion

Price is compressing under pivot with AVWAP overhang—bulls need a clean reclaim above these levels and RS reacceleration to validate the next leg.

Keep reading with a 7-day free trial

Subscribe to The Trading Report BY SHRED to keep reading this post and get 7 days of free access to the full post archives.